We’re a regular Aussie couple with a 6 figure passive income post all expenses. We hold 14 properties, have 20 rental income sources, and own a portfolio worth $9.1 million. We live life on our own terms, spending our time with whomever we choose, in whatever way we desire. (And we’re only in our mid-30s). Our wealth isn’t just in money—it’s in having the freedom to decide how we use our time. That’s the true luxury!

We started Tailored Property Group to help everyday Aussies just like you:

So you never have to feel like you’re missing out on life.

We’ve seen firsthand how property investing can transform lives, including ours. That’s why we’re on a mission: to guide 250 investors into Australia’s top 1% of investors by 2035.

A short 13 years ago, life was very different for us.

Michael was an electrician. He was earning roughly $52,000 per year.

Nicole was a registered nurse. She was only on $34,000 per year.

Both of us were tired of working long hours every day and watching our lives race ahead of us:

We started looking into property to hopefully give us the independence we were craving. At age 21, Michael bought a townhouse in St Marys, NSW.

Just after turning 23, Nicole joined Michael in purchasing a freestanding house in South Wentworthville, NSW.

From there, it was game on.

We started buying more and more properties. The first couple of properties weren’t the best investments. To be dead honest, we didn’t know what on earth we were doing. We just knew we had to start somewhere.

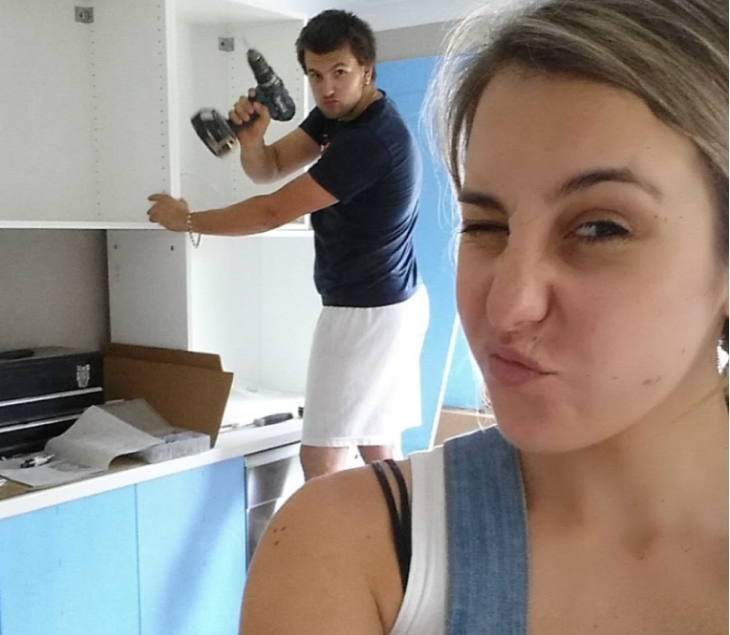

Our goal was to achieve financial independence and live life on our own terms. So, we began buying more properties and renovating them ourselves.

Despite buying and renovating properties, something was wrong.

We were heavily in debt, mortgaged, seeing no growth, and were constant slaves to the bank.

In 2017, it suddenly hit us.

We realised we had been doing it all wrong.

We were jumping into deals without a solid strategy…

We were overspending on renovations…

We had no real robust long-term plan in place…

To put it simply – we were stuck.

And so, in 2018, we changed our way of thinking.

And hit a breakthrough.

We learned to be creative with our approach.

We decided to add value to our properties with innovative strategies like:

These experiences were our greatest lessons, and once tested and proven in our own portfolio, they became the heart of Tailored Property Group.

We developed a system to obtain a 6-figure passive income not just for ourselves – but for our friends and (now) our clients.

We both finally earned enough money to replace our full-time income,

We’re continuing to grow our portfolio,

And we spend every day doing what we love doing.

We’ll counsel you every step of the way so that we can boost the return on your investment as much as possible.

Not new to investing, Bartosz and Kinga entrusted us to help scale their property portfolio. Initially, Bartosz was cautious, but after his first acquisition with us, his mindset expanded. He recognised the value of our approach to properties, distinguishing us from most agents. This shift changed his perspective on property investing, leading him to a strategy focused on growth through cosmetic value and structural value add.

Aretta and Aleco, newcomers to property investing, sought our expertise. Despite a modest starting budget and a desire for positive cash flow, they were determined not to halt their investment journey after just one purchase.

We identified an opportunity in a property requiring some renovations, allowing us to negotiate a significantly lower price. By embarking on a value-add project and meticulously planning the repairs and renovations, we not only addressed the issues but also created equity and enhanced the property’s rental value.

In just 6 weeks, their strategic investment paid off: the purchase price of $258,000 soared to a value of $320,000 (a 24.03% increase), now generating $460 per week in rent.

Aretta and Aleco’s venture into property investing is a clear example of how informed decisions and a bit of courage can set the stage for a solid start to their investment journey.

We empowered these first-time investors seeking a neutrally geared property for their SMSF purchase.

Their property grew by 17.66% in the first year and 22.54% in the second year, achieving a total growth of 40.2% since purchase. This was achieved using a straightforward ‘growth-only’ strategy, commonly known as a simple buy and hold.

Copyright 2025 Tailored Property Group